Indian Journal of Science and Technology

Year: 2020, Volume: 13, Issue: 39, Pages: 4151-4160

Original Article

Karen Razelle M Duyan1*, Angeline L Labbutan1

1College of Business Entrepreneurship and Accountancy, Kalinga State University, Philippines. Tel.: +63 9153112425

*Corresponding Author

Tel: +63 9153112425

Email: [email protected]

Received Date:30 March 2020, Accepted Date:16 October 2020, Published Date:07 November 2020

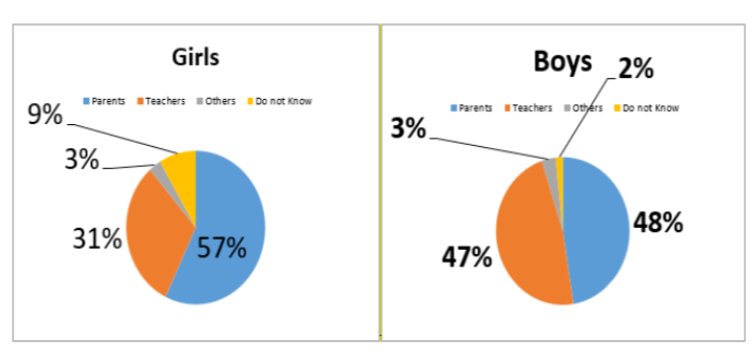

Objectives: The study aimed at ascertaining the awareness of money and determine whether the respondents can recognize currency coins and bills. It also seeks to identify the source of money education among children based on age and sex and identify the their buying preference with and without inducements. Finally to analyze the significant difference on the preference with and without inducements when grouped according to their profile variables. Methods/Statistical analysis : The respondents of the study are the 94 children enrolled at the Kalinga Special Education Center during the School Year 2018-2019 whose age ranges 6-7 years old. The study utilized the descriptive-comparative research design. In analyzing the data obtained statistical tools like frequency, percentage and t-test were used. The study utilized the descriptive-comparative research design. Findings: The study revealed that children recognize bills more accurately as compared to coins, and most of the children who are allowed to make purchase from the supermarket of their own choice pick nonfood item which signifies that they are unable to appreciate the value of money as also seen in their preference of the more expensive pencil over the cheaper one, provided that it is the same pencil shown in the initial experiment. Recommendation: It is recommended that educators, families and the communities teach young people the early recognition and institute a sense of obligation in money spending through Trainings on Financial Literacy and Capabilities.

Keywords: Money awareness; children; spending; price

© 2020 Duyan & Labbutan.This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. Published By Indian Society for Education and Environment (iSee).

Subscribe now for latest articles and news.