Indian Journal of Science and Technology

Year: 2020, Volume: 13, Issue: 23, Pages: 2328-2335

Original Article

Tanvir Khaliq Shami1*, Sultan Ali Adil1, Sarfraz Hassan1, Muhammad Khalid Bashir1

1Institute of Agricultural and Resource Economics, University of Agriculture Faisalabad, 38040, Pakistan. Tel.: +92-300-666-7661

*Corresponding author

Tanvir Khaliq Shami

Institute of Agricultural and Resource Economics, University of Agriculture Faisalabad, 38040, Pakistan.

Tel.: +92-300-666-7661

Email: [email protected]

Received Date:26 April 2020, Accepted Date:10 June 2020, Published Date:06 July 2020

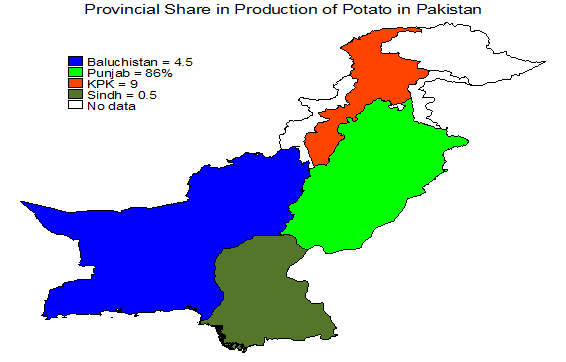

Background/ Objectives: This study investigated market integration and asymmetric price transmission in the potato markets for the seven major Potato markets, i.e., Okara, Faisalabad, Sargodha, Lahore, Gujranwala, Multan, and Rawalpindi in the province of Punjab, Pakistan. Methods/Statistical analysis: The study estimated the data by using the Johansen Co-integration (JJ) technique, vector error correction model, and Vector autoregressive (VAR) model. Findings: The empirical results show as major Potato markets are integrated, i.e., there exist the law of one price. These findings also supported the results of the Granger causality analysis. The results of pairwise granger casualty show the direction of price transmission between the selected Potato markets in Punjab, Pakistan. Application: These results suggest for market integration and competition rather than collusion in Potato markets in Punjab, Pakistan, and provide little justification for government intervention designed to improve competitiveness or to enhance market efficiency.

Keywords: Market integration; Potato; Co-integration; Causality

© 2020 Shami, Adil, Hassan, Bashir. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Published By Indian Society for Education and Environment (iSee)

Subscribe now for latest articles and news.