Indian Journal of Science and Technology

Year: 2023, Volume: 16, Issue: 26, Pages: 1958-1966

Original Article

Arfat Manzoor1*, Andleebah Jan2, Mohammad Shafi3

1Ph.D. Research Scholar, Department of Commerce, University of Kashmir, India

2Ph.D. Research Scholar, Department of Management studies, IUST, Awantipora, India

3Ex-Professor, Department of Commerce, University of Kashmir, India

*Corresponding Author

Email: [email protected]

Received Date:10 April 2023, Accepted Date:17 June 2023, Published Date:04 July 2023

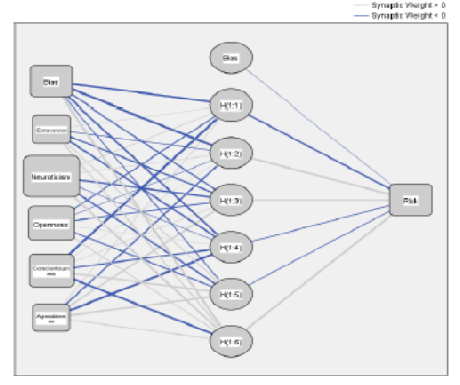

Objectives: The purpose of this study is to determine the impact of Big-Five personality traits on the Risk perception of women retail investors in North India. Methods: The study adopts a survey approach. The sample comprises 360 active women retail investors investing in the Indian stock exchange. This study adopts a hybrid approach to analysis. Two analysis techniques PLS-SEM and Artificial Neural Network approach are used for data analysis. Findings: Results of the study shows the significant impact of Big-Five personality traits on the Risk perception of retail women investors in the Indian Stock Market. PLS-SEM results showed a positive and significant impact of neuroticism (b = 0.215) and conscientiousness (b = 0.234) while a negative significant impact of extraversion (b = -0.129), openness to experience (b = -0.102) and agreeableness (b = -0.156) on risk perception. The ANN results also confirmed these results and ranked neuroticism as the most influential predictor. Novelty: Investor participation in Indian Stock Market has increased significantly in recent years. However, being an economic leader, Indian Stock Markets lack the participation of female investors. To improve the ratio of women investors, advisors and government plays an important role. This study is the first of its kind which involves women investors as a study sample and determines their risk perception level. The other novel factor that distinguishes this study from the previously conducted studies is its hybrid analysis approach. This study adopts both linear (PLS-SEM) and non-linear (ANN) approaches for data analysis.

Keywords: BigFive personality traits; Risk perception; Women investors; PLSSEM; ANN

© 2023 Manzoor et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. Published By Indian Society for Education and Environment (iSee)

Subscribe now for latest articles and news.