Indian Journal of Science and Technology

Year: 2024, Volume: 17, Issue: 24, Pages: 2469-2477

Original Article

Prakhyath Rai1∗, Bellipady Shamantha Rai1, Permanki Guthu Rithesh Pakkala1, R Akhila Thejaswi1

1Sahyadri College of Engineering & Management, Mangaluru, Karnataka and Affiliated to Visvesvaraya Technological University, Belagavi, Karnataka, India

*Corresponding Author

Email: [email protected]

Received Date:17 February 2023, Accepted Date:23 May 2024, Published Date:10 June 2024

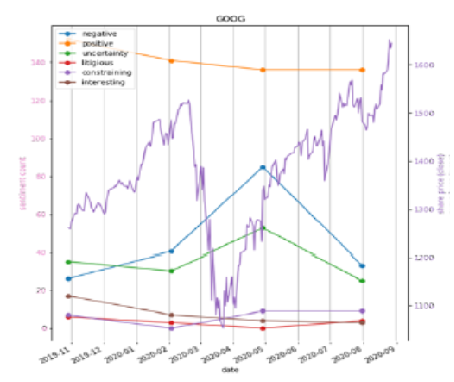

Objectives: The research work focuses on providing an effective framework for automated text refinement that aids in financial condition projections for the company based on prior transcripts of earnings calls. The proposed framework captures the ad hoc advancements of the organizations described in the earnings call as sentiments and computes a score based on the captured sentiments. The sentiment score is then used as prime parameter to predict the stock values of the organizations. Methods: The framework is equipped with sentiment analysis or opinion mining to identify and extract the subjective content using text mining and Natural Language Processing (NLP). The extracted sentiments help in yielding a sentiment score to aid in the process of stock projection. The research also illustrates how the sentiment score-based stock prediction enhances in projections of stock compared to existing ML frameworks like LSTM, Random Forest, ARIMA and Regression models. Findings: The proposed work has an accuracy score of 93%, precision 96% and recall 95% which is comparatively better than existing ML frameworks framed on LSTM, Random Forest, ARIMA and Regression models. Novelty: The research framework overcomes the influence of regular features and test data in stock prediction by using the computed sentiment prediction score from the extracted sentiment phase to aid in prediction stock values and determine the financial status of organizations. The existing frameworks project the stock price based on trained model from previous stock price repository, which tend to fail capturing ad hoc changes incurring in the organization such as change of management or any economic disaster which can poses a high impact on stock projections, the proposed research work captures these organizational changes from the earnings call transcripts as sentiments and build a score to yield the stock projection framework.

Keywords: Natural Language Processing, Text Refinement, Loughran McDonald Sentiment Classifier, Term Frequency Inverse Document Frequency, Stock Price

© 2024 Rai et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. Published By Indian Society for Education and Environment (iSee)

Subscribe now for latest articles and news.