Indian Journal of Science and Technology

Year: 2024, Volume: 17, Issue: 8, Pages: 670-678

Original Article

Anurag Shukla1, Manish Dadhich2, Dipesh Vaya1*, Anuj Goel3

1Assistant Professor, School of Management, Sir Padampat Singhania University, Udaipur, Rajasthan, India

2Associate Professor, School of Management, Sir Padampat Singhania University, Udaipur, Rajasthan, India

3Vice President, Global Bank, India

*Corresponding Author

Email: [email protected]

Received Date:10 November 2023, Accepted Date:21 January 2024, Published Date:14 February 2024

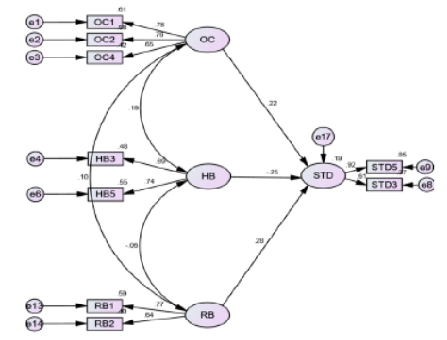

Objective: This paper aims to investigate the impact of specified behavioral biases on investors' stock trading decisions in North India. It has been observed that most of the research works are based on financial theories, which affect investment decisions. But besides the theories nowadays, behavioral biases also play an important role in investment decisions, which was less focused in the previous literature. Methods: The study used primary data collected from a sample from North Indian States (Uttar Pradesh, Delhi, Haryana, and Punjab) through a structured questionnaire to analyze the impact of specified behavioral biases on investors' stock trading decisions. We used structural equation modelling to find out the significant impact of behavioral biases on stock trading and investment decisions. Findings: The investigation determined that the majority of the designated cognitive biases, such as the Overconfidence Bias, the Representativeness Bias, and the Herding Bias, exert a significant influence on the decisions about stock trading and investment made by investors. Novelty: The ample research in this domain has primarily occurred in various countries, with only a limited number of studies conducted specifically at the Indian level. Nevertheless, based on the literature review, it is evident that this study is groundbreaking in North India. The objective of this research is to enhance the effectiveness of financial advisors by gaining a deeper understanding of the psychological aspects of clients. This, in turn, will aid in developing portfolios tailored to individual behavior, aligning with client preferences. Recognizing and addressing behavioral biases is crucial for individual investors as they strive to make informed and successful financial decisions.

Keywords: Behavioral Biases, Overconfidence (OC) bias, Representativeness Bias (RB), Herding Bias (HB), Structural Equation Modelling

© 2024 Shukla et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. Published By Indian Society for Education and Environment (iSee)

Subscribe now for latest articles and news.