Indian Journal of Science and Technology

Year: 2020, Volume: 13, Issue: 27, Pages: 2700-2710

Original Article

Summaira Malik1, G Mustafa2*, A Anwar2, A Iqbal2

1Assistant Professor, Department of Economics, COMSATS University Islamabad, Lahore Campus, Lahore, 54000, Punjab, Pakistan

2Assistant Professor, Department of Economics and Business Administration, Division of Arts and Social Sciences, University of Education, Lahore, 54000, Punjab, Pakistan. Tel.: +92-304-4842288

*Corresponding author

Tel.: +92-304-4842288

Email: [email protected]

Received Date:07 June 2020, Accepted Date:01 July 2020, Published Date:31 July 2020

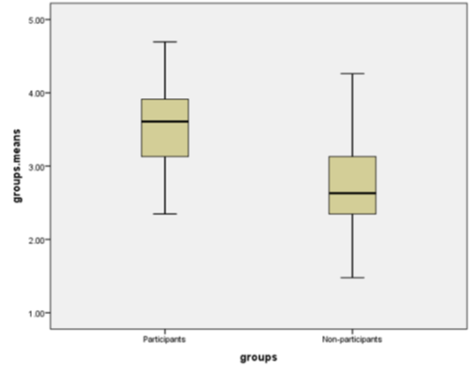

Background/Objectives: Some recent studies have empirically proved that micro-finance schemes launched for women empowerment have failed to attain their required goals as women are just used as a tool to get loans; In this context, the present study is undertaken to verify the usefulness of microcredit for women empowerment in Pakistan. Methods/Statistical analysis: Quantitative approach is used to assess the impact of microfinance loan services on women economic empowerment and to see whether members of microfinance institutes are equally empowered to the nonmembers. For this purpose, survey was conducted in Multan District of Punjab, Pakistan. Independent sample t-test is used to estimate the difference between two independent groups of participants. In a sample size of 300 women, 200 are participants of MFI while rest of the 100 are non-participants. The data has been analyzed by using Independent-samples t-test, as it is the comparison of two different independent groups. Findings: The study shows that women members of micro-finance institutions (MFIs) are more empowered compared to non-members. Overall, the results show that there is a positive relationship between MFI and women economic empowerment in Multan. Women participants of MFI have greater role in decision-making, more autonomy in mobility, greater control over income and savings generated from income generating activities, more role in employment generation and increased ownership of productive assets and property than non-member MFIs. Novelty/Applications: The current study presents a case for a nuanced and more-sophisticated analysis of the linkages between MFIs memberships and women's empowerment. Empowerment alone may not automatically lead to empowerment, but networks and guidance also important factors that can determine the success or failure of the empowerment approach. Thus, MFIs should hold meetings with women to guide them about the proper use of loan in their business activities.

Keywords: Gender; independent-samples t- test; microfinance institutes; women-empowerment; Multan

© 2020 Malik, Mustafa, Anwar, Iqbal. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. Published By Indian Society for Education and Environment (iSee)

Subscribe now for latest articles and news.