Indian Journal of Science and Technology

DOI: 10.17485/IJST/v17i14.3193

Year: 2024, Volume: 17, Issue: 14, Pages: 1439-1449

Original Article

Godbless G Minja1*, Devotha G Nyambo1, Anael E Sam1

1The School of Computational and Communication Sciences and Engineering, The Nelson Mandela African Institution of Science and Technology, P. O. Box 447, Tengeru, Arusha, Tanzania

*Corresponding Author

Email: [email protected]

Received Date:20 December 2023, Accepted Date:07 March 2024, Published Date:03 April 2024

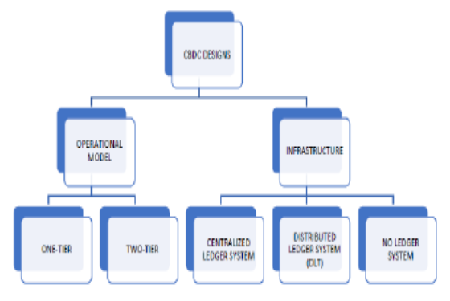

Objectives: This work aims to contribute towards Tanzanian Central Bank Digital Currency (CBDC) users’ privacy preservation. It proposes the design of a privacy preserving CBDC which might be issued by Tanzania's Central Bank (CB), the Bank of Tanzania (BoT), which is currently in CBDC research phase. The work also aims to contribute to literature, the CBDC research being done by BoT, other CBs and CBDC stakeholders around the world. Methods: By using the Design Science Research (DSR) methodology, a privacy preserving CBDC design suitable for Tanzania was proposed, demonstrated and evaluated. This is the result of existing literature showing that different countries have different CBDC designs due to their differences in contexts and purposes for CBDC issuance. This consequently emphasized the fact that a CBDC design should not be treated as a one-size fits all solution. Findings: As opposed to the existing general and other country specific CBDC designs, we proposed a privacy preserving CBDC design suitable for Tanzania by consulting literature and taking into consideration the Tanzanian context. The design appears to be promising Tanzanian CBDC users’ privacy preservation though further work needs to be done. The work should not only be on practical evaluation of the proposed design but also on other factors impacting the success of CBDC projects. This will consequently further increase the success probability of CBDC projects, hence the potential for practical realization of CBDC project benefits. Novelty: Existing literature has shown that, considering the countries’ differences in context and CBDC issuance purposes, CBDC design should not be treated as a generic solution thereby obliging the need for country-specific CBDC designs. Consequently, the privacy preserving CBDC design suitable specifically for Tanzania consists of and provides an outline of privacy preserving interactions among the identified key Tanzanian CBDC participants or actors. The actors are the BoT, the intermediaries (i.e., other banks and payment service providers), Tanzania’s National Identification Authority (NIDA), financial transactions violation detection engine, and the expected CBDC users.

Keywords: Digital currency, database privacy, central bank digital currency, privacy

© 2024 Minja et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. Published By Indian Society for Education and Environment (iSee)

Subscribe now for latest articles and news.